In an era where digital transformation dictates the pace of advancements across industries, the insurance sector stands at a pivotal juncture. Traditional business models, once the backbone of insurance companies, are now challenged by the rising expectations of a tech-savvy generation.

Customers demand not just coverage but personalized experiences, swift service, and transparency. This shift necessitates embracing technological innovation, where Customer Relationship Management (CRM) systems, notably Salesforce, play a crucial role. With its comprehensive suite of services, Salesforce is not just a tool but a transformative force in the insurance industry. It enables companies to navigate the complexities of modern-day insurance with agility and foresight.

The Evolution of the Insurance Industry with CRM Solutions

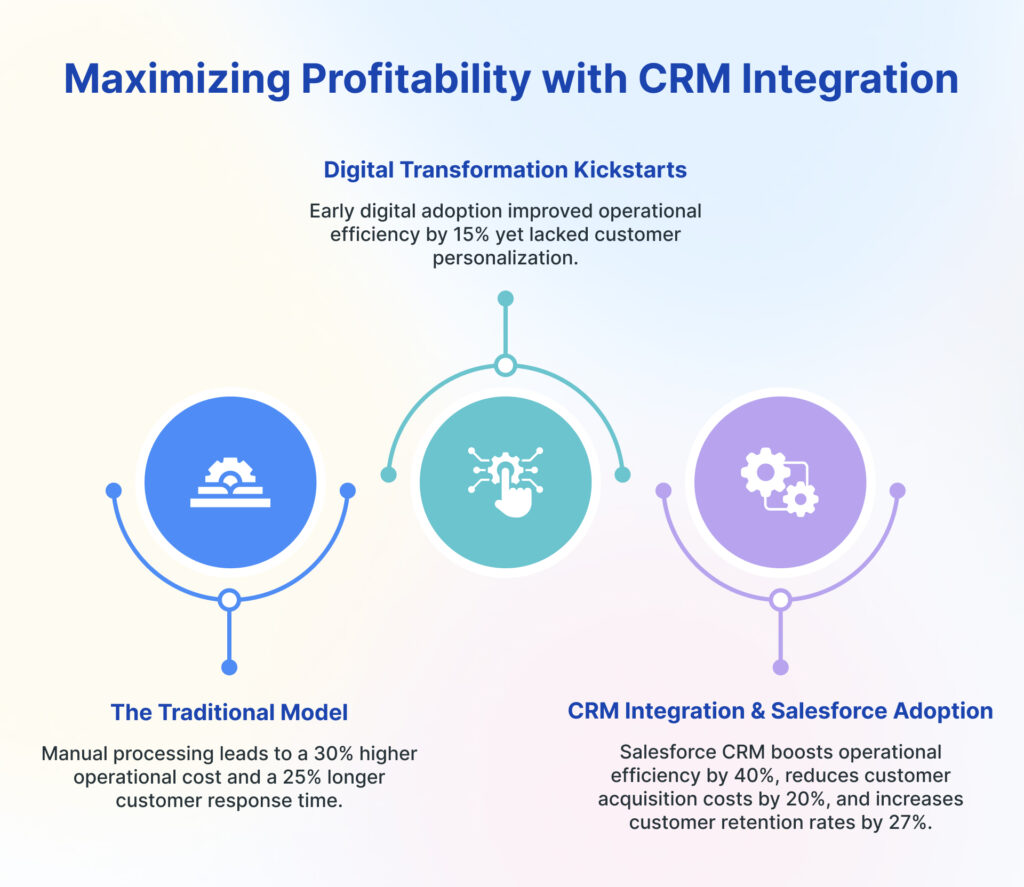

The journey from traditional, paper-based insurance processes to digital, customer-centric models marks a significant evolution in the industry. This transformation is primarily fueled by the integration of CRM solutions, with Salesforce leading the charge.

Salesforce CRM has revolutionized how insurance companies manage customer relationships, offering a 360-degree view of the customer, streamlining operations, and enhancing data management. This evolution is not just about technological adoption but about redefining the insurance landscape to be more responsive, efficient, and personalized.

From Traditional Models to Customer-Centric Approaches

A one-size-fits-all approach, with limited interaction between the insurer and the insured, characterized the traditional insurance model. Today, the focus has shifted towards creating value for customers, understanding their unique needs, and offering tailored solutions.

Salesforce CRM facilitates this shift by providing deep insights into customer behaviour, preferences, and feedback, enabling insurers to craft policies and services that resonate with individual customers.

The Impact of Salesforce CRM on Customer Relationship Management in Insurance

Salesforce CRM’s impact on customer relationship management in insurance is profound. It offers tools for marketing automation, customer service, and analytics, all designed to enhance the customer experience. Insurance agents can now track customer interactions, manage leads more effectively, and deliver personalized communication, all of which contribute to increased customer satisfaction and loyalty.

Salesforce at the Heart of Technological Transformation

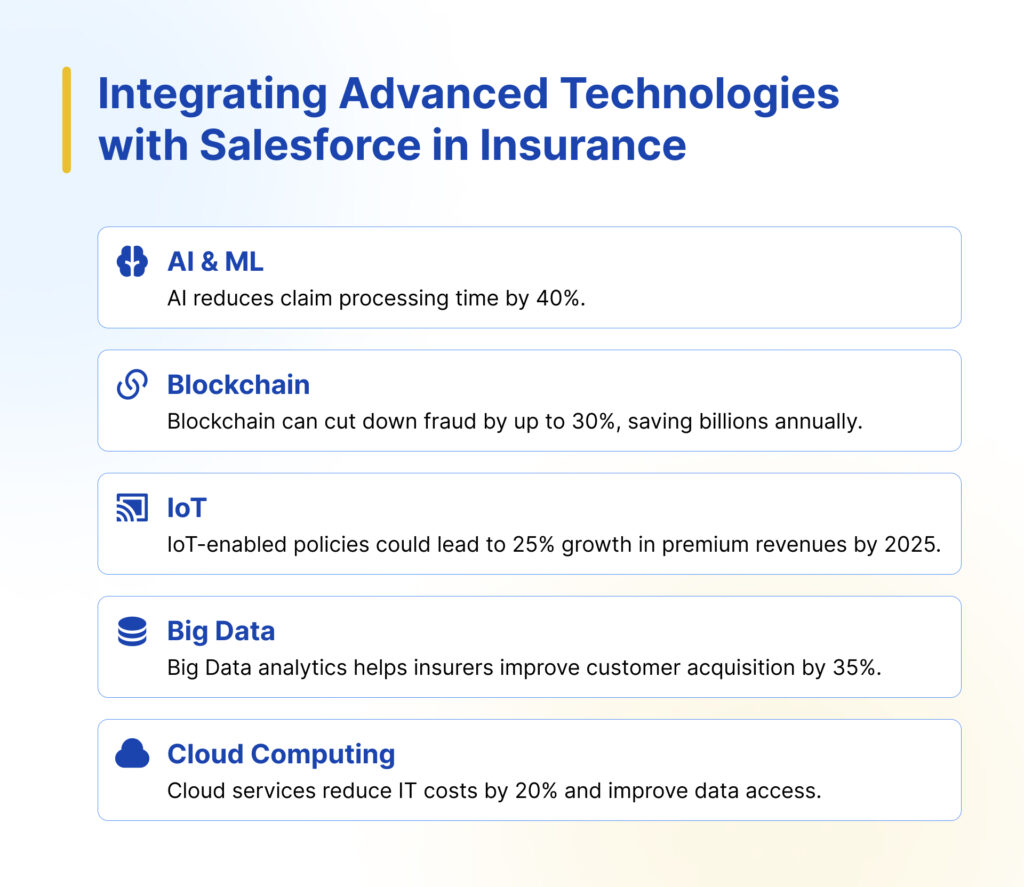

Salesforce is not just another CRM platform; it’s a comprehensive ecosystem that integrates advanced technologies to provide innovative solutions for the insurance industry. Its ability to seamlessly connect with AI, blockchain, IoT, big data, and cloud computing makes it an indispensable tool for insurers looking to stay ahead in a competitive landscape.

Overview of Salesforce Solutions Tailored for the Insurance Industry

Salesforce offers a range of products specifically designed for the insurance sector, such as Salesforce Financial Services Cloud, which is tailored to meet the unique needs of insurance companies. This platform enables insurers to deliver a more personalized service, streamline operations, and gain comprehensive insights into their business processes.

Salesforce and the Power of Personalized Customer Journeys

With Salesforce, insurance companies can map out and manage personalized customer journeys. From initial contact to policy renewal, Salesforce ensures every touchpoint is an opportunity to enhance the customer experience. This customized approach improves customer satisfaction and drives loyalty and retention.

Artificial Intelligence and Machine Learning: Salesforce Einstein for Insurance

The advent of Artificial Intelligence (AI) and Machine Learning (ML) in insurance, mainly through Salesforce Einstein, is revolutionizing how insurers assess risks, manage customer service, and predict trends. Salesforce Einstein integrates AI across the platform, enabling insurance companies to become more proactive and personalized in their offerings.

Leveraging Salesforce Einstein for Smarter Risk Assessment and Management

AI and ML technologies facilitate a more nuanced and dynamic approach to risk assessment. For instance, Salesforce Einstein can analyze vast datasets to identify patterns and predict outcomes, leading to more accurate risk assessments. According to a report by McKinsey, AI can reduce underwriting costs by as much as 30%, significantly impacting profitability.

Enhancing Customer Interactions with AI-powered Salesforce Chatbots

Salesforce Einstein also powers intelligent chatbots that can handle customer inquiries 24/7, providing instant responses and freeing up human agents for more complex issues. A survey by Salesforce revealed that 69% of consumers prefer chatbots for quick communication with brands, highlighting the importance of AI in enhancing customer service.

Predictive Analytics in Insurance: Improving Accuracy and Decision-Making with Einstein

Predictive analytics, powered by AI and ML, allows insurers to forecast future claims and customer behaviour with a higher degree of accuracy. Salesforce Einstein’s predictive analytics tools enable insurers to tailor their marketing efforts, identify potential churn risks, and offer personalized policies. According to Salesforce research, companies utilizing predictive analytics have seen a 21% increase in lead conversion rates.

Blockchain Technology: Enhancing Trust with Salesforce Integration

Blockchain technology offers unparalleled security, transparency, and efficiency, making it a perfect match for the insurance industry’s needs. When integrated with Salesforce, blockchain can streamline processes, reduce fraud, and enhance customer trust.

The Synergy Between Salesforce and Blockchain for Secure Transactions

Blockchain’s decentralized ledger provides a secure and immutable record of transactions, ideal for claims processing and policy management. Integrating blockchain with Salesforce allows for seamless and secure data sharing between parties, reducing the risk of fraud. A study by Accenture indicates that blockchain could save the insurance industry up to $10B by streamlining processes and reducing fraud.

Automating Insurance Contracts with Salesforce and Smart Contracts

Smart contracts, powered by blockchain, automate the execution of insurance contracts when predefined conditions are met, eliminating the need for manual processing. This automation can significantly reduce processing times and costs. For example, AXA’s Fizzy platform uses smart contracts to automate flight delay insurance payouts, demonstrating the potential for efficiency gains.

Internet of Things (IoT): Salesforce IoT for Real-time Policy Management

The Internet of Things (IoT) connects physical devices to the Internet, providing real-time data that insurers can use to offer personalized policies and proactive services. Salesforce IoT bridges the gap between these devices and insurance data management, enabling new levels of service customization.

Connecting IoT Devices with Salesforce for Dynamic Policy Adjustments

IoT devices, such as wearable health monitors and connected home sensors, provide insurers with real-time data on risk factors. Salesforce IoT can dynamically process this data to adjust policies and premiums, offering more accurate pricing. The global IoT in insurance market size is expected to reach $70 billion by 2024, according to a report by MarketsandMarkets, indicating the growing importance of IoT in the industry.

Utilizing Salesforce IoT Insights for Personalized Insurance Solutions

By analyzing data from IoT devices, insurers can offer personalized advice and services, such as preventive maintenance alerts for homes and vehicles. That not only enhances customer satisfaction but also reduces claims. A survey by the IoT Insurance Observatory found that insurers leveraging IoT data could improve their combined ratio by 6 to 9 percentage points, highlighting the potential for cost savings and improved profitability.

Leveraging Big Data and Analytics for Informed Decisions

The insurance industry is inherently data-driven. With the advent of big data technologies, insurers can now process and analyze vast amounts of data for deeper insights into customer behaviour, risk management, and operational efficiency. Salesforce plays a pivotal role in harnessing the power of big data for the insurance sector.

The Role of Big Data in Understanding Customer Behavior

Big data analytics allow insurers to segment customers more accurately, predict behaviours, and tailor products and services to meet individual needs. According to IBM, 62% of insurers report using information (including big data) and analytics creates a competitive advantage for their organizations. With its robust analytics capabilities, Salesforce enables insurers to leverage big data to its fullest potential, offering a 360-degree view of the customer.

Analytics for Competitive Pricing and Product Development

Through extensive data analysis, insurers can identify trends, assess risks more accurately, and develop competitive pricing strategies. Salesforce’s analytics tools provide actionable insights that can drive product development and customization. A study by Deloitte highlighted that companies leveraging analytics have seen a 20% increase in customer satisfaction.

Enhancing Claims Management with Data Insights

Big data analytics also streamline and improve the claims process, making it faster and more efficient. By analyzing historical data, insurers can identify patterns that help in fraud detection and risk assessment. Salesforce’s platform enables insurers to integrate these insights into their claims management processes, significantly reducing processing times and costs. According to a report by McKinsey, insurers using advanced analytics for claims management have seen a reduction in claim costs by 5-10%.

Cloud Computing: Salesforce Cloud Solutions for Scalable Insurance Services

Cloud computing, including the insurance industry, has become a cornerstone for businesses seeking scalability, flexibility, and efficiency. Salesforce’s cloud solutions offer insurers a powerful platform to manage their operations, data, and customer interactions seamlessly.

The Strategic Advantage of Salesforce Cloud in the Insurance Industry

Salesforce Cloud provides insurers with the agility to scale services up or down based on demand, improve collaboration across teams, and enhance data security. According to a report by Global Industry Analysts, the global cloud computing market size in the insurance industry is expected to grow significantly, projected to reach $8.9 billion by 2026. Salesforce Cloud is at the forefront of this transformation, offering a suite of applications designed to meet the unique needs of the insurance sector.

Discussing the Benefits of Cloud Computing: Flexibility, Scalability, and Cost-Efficiency

Adopting cloud computing allows insurance companies to reduce IT costs, improve system performance, and ensure data integrity. Salesforce Cloud, in particular, offers a cost-effective solution for managing customer relationships, policy administration, and claims processing on a single platform. According to a survey by Forrester, insurers that have migrated to the cloud report a 20% reduction in IT spending.

Ensuring Data Security and Regulatory Compliance with Salesforce Cloud

Data security and regulatory compliance are paramount in the insurance industry. Salesforce Cloud provides robust security features that comply with industry standards and regulations, protecting sensitive customer data. Salesforce’s commitment to security is evidenced by its compliance with frameworks such as ISO 27001, SOC 1, and SOC 2, providing insurers with the confidence to manage their operations in the cloud.

Overcoming Challenges with Salesforce Adoption in Insurance

While the integration of Salesforce and advanced technologies offers immense potential for the insurance industry, companies face several challenges in adoption. Addressing these challenges is crucial for realizing the full benefits of digital transformation.

Navigating Regulatory and Compliance Issues with Salesforce Solutions

The insurance industry is heavily regulated, with stringent data protection, privacy, and compliance requirements. Salesforce provides a framework supporting compliance with global regulations such as GDPR, HIPAA, etc. However, insurers must ensure that their use of Salesforce and other technologies aligns with local regulations. Proactive measures, including regular audits and adopting best practices in data governance, can mitigate risks. According to a PwC survey, 92% of C-suite executives believe that information governance is essential to data security and regulatory compliance.

Addressing Data Privacy and Security in the Salesforce Ecosystem

Data privacy and security are paramount concerns for insurance companies. Salesforce offers robust security features, including encryption, access controls, and event monitoring. Despite these measures, insurers must adopt a comprehensive security strategy that includes employee training, regular security assessments, and a clear response plan for potential breaches. A report by IBM found that the average cost of a data breach in the financial sector is $5.85 million, highlighting the importance of stringent security measures.

Strategies for Fostering Digital Literacy and Salesforce Training Among Employees

The successful adoption of Salesforce and advanced technologies requires a digitally literate workforce. Insurance companies must invest in training programs to enhance employees’ skills and knowledge. Salesforce offers many training resources through its Trailhead platform, but insurers must encourage and facilitate ongoing learning. Deloitte’s research indicates that companies investing in employee development see a 34% higher retention rate and a significant increase in innovation and performance.

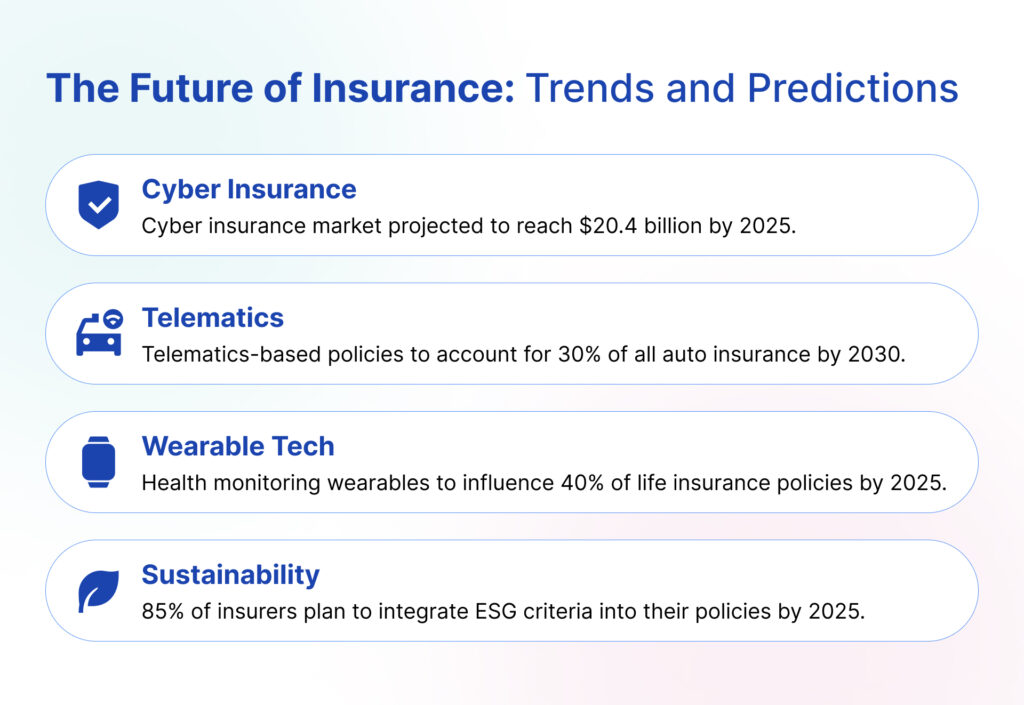

The Future of Insurance: Salesforce and Emerging Technology Trends

As we look to the future, the integration of Salesforce with emerging technologies will continue to shape the insurance industry. These trends promise enhanced efficiency and customer satisfaction and open new product development and market expansion avenues.

The Integration of Cyber Insurance Solutions Within Salesforce

With the increasing threat of cyber attacks, cyber insurance has become a critical offering. Salesforce’s robust security framework and predictive analytics can help insurers assess cyber risks more accurately and develop tailored cyber insurance products. The global cyber insurance market is expected to reach $20.4 billion by 2025, according to a report by MarketsandMarkets, indicating a significant growth opportunity for insurers.

Exploring the Potential of Telematics and Wearable Technology with Salesforce

Telematics and wearable technology allow insurers to collect real-time customer behaviour and health data. Integrating this data with Salesforce enables insurers to offer usage-based and health-conscious insurance products, enhancing personalization and risk assessment. A study by Allied Market Research predicts that the global telematics market will reach $320.6 billion by 2026, underscoring the potential for innovation in insurance products.

Future Advancements in AI, ML, and IoT Within the Salesforce Framework

The evolution of AI, ML, and IoT technologies will further enhance Salesforce’s capabilities in the insurance industry. From more sophisticated risk models to automated customer service and claims processing, these advancements promise to transform every aspect of insurance operations. Gartner predicts that by 2025, AI and advanced analytics will be embedded in every phase of the insurance lifecycle, from marketing to claims settlement.

Sustainable and Ethical Insurance Practices Powered by Salesforce Technology

As societal expectations shift towards sustainability and ethical business practices, insurers increasingly focus on ESG (Environmental, Social, and Governance) criteria. Salesforce’s analytics and reporting tools can help insurers measure and report on ESG performance, aligning insurance products with sustainable practices. According to a survey by Willis Towers Watson, 83% of insurance executives believe ESG factors will significantly impact their risk assessment and product development strategies within the next five years.

Also Read: Strengthening Loan Processing Efficiency With A Unified Platform

Conclusion

Integrating Salesforce and advanced technologies offers a blueprint for the insurance industry’s future. By embracing digital transformation, insurers can achieve greater efficiency, enhance customer satisfaction, and unlock new growth opportunities. The journey requires navigating challenges, including regulatory compliance, data security, and digital literacy, but the potential rewards are significant. As we look ahead, the continued evolution of technology promises to reshape the insurance landscape further, driving innovation and profitability in an increasingly competitive market.