Prompt templates in Salesforce Finance and Operations workflows are redefining how businesses handle financial processes. Traditionally, tasks such as invoice processing, expense management, contract analysis, and compliance reporting have been repetitive, compliance-heavy, and resource-intensive. With Salesforce fintech services and Salesforce integration, organizations now benefit from AI-driven claims processing and Salesforce automation that enhances speed and accuracy.

Corpay says, According to a study by Aberdeen Group, AP invoice automation can reduce invoice processing costs by 80% and increase processing speed by 70% versus manual methods. Moreover, the global financial-automation-market was valued at USD 6.6 billion in 2023 and is forecasted to grow at a CAGR of 14.2% through 2032. By embedding Salesforce process automation into financial services, companies can reduce operational costs and ensure compliance while maintaining data integrity.

This blog explores the role of Salesforce prompt templates in reshaping finance workflows in Salesforce — covering invoice processing, Salesforce expense management, contract lifecycle management, and Salesforce compliance management for more reliable and efficient operations.

What are Salesforce Prompt Templates in Finance & Operations?

Prompt Templates in Salesforce Finance & Operations are declarative, reusable blueprints created using Salesforce Agentforce Prompt Builder. They serve as guided instructions for Einstein Copilot and other Salesforce AI tools, enabling the delivery of structured, consistent, and context-aware results using reliable CRM data.

Unlike generic AI prompts that depend on open-ended inputs, Salesforce Prompt Templates connect securely to Finance Cloud and Operations objects such as invoices, expenses, contracts, or compliance records. This ensures every output is accurate, relevant, and aligned with your business rules.

Administrators and developers can configure how AI interacts with Salesforce data fields, define business logic, and send results directly into the platform—without exposing sensitive financial information. The outcome is safer, audit-ready automation that helps finance teams handle key processes like invoice validation, expense reporting, and compliance tracking—all within Salesforce’s trusted AI environment.

By combining Salesforce financial services automation with intelligent prompt design, organizations gain better control, faster insights, and improved accuracy across every financial workflow.

Manual vs Automated Workflows in Salesforce Finance

| Manual Workflows | With Salesforce Prompt Templates |

|---|---|

| Repetitive invoice checks | Salesforce Finance Cloud automates invoice processing |

| Manual compliance logs | Best practices for compliance documentation in Salesforce |

| Time-consuming expense reports | Automating expense tracking with Salesforce Finance Cloud |

| Contract reviews are prone to errors | Salesforce contract analysis automation with AI templates |

By using Salesforce prompt templates for finance and operations workflows, organizations strengthen financial accuracy while leveraging Salesforce workflow templates for long-term efficiency.

Case Study: How Salesforce Prompt Templates Are Transforming Finance and Operations

Use Case 1: Streamlining Invoice Processing with Salesforce Prompt Templates

Invoice processing involves handling vendor invoices from receipt and validation to approvals and payment. Many organizations rely on manual processes that are slow, prone to errors, and lead to compliance risks. Leveraging Salesforce solutions for automated invoice processing software helps to automate these workflows, improve accuracy, and reduce operational delays.

Challenges

Finance teams often struggle with:

Duplicate entries: Manual entry can create duplicate invoices, leading to inaccurate reporting and reconciliation issues.

Delayed approvals: Slow manual approvals affect cash flow and vendor trust.

Data mismatches: Discrepancies between invoices and purchase orders increase the risk of regulatory non-compliance.

Solution: Salesforce Prompt Templates

Salesforce prompt templates, combined with Finance Cloud and Finance & Operations, automate key aspects of invoice management:

Accurate data extraction: AI templates pull key invoice details such as vendor name, due date, and payable amount.

Auto-classification: Invoices are automatically categorized based on pre-defined rules to meet accounting and compliance standards.

Workflow automation: Approval processes are triggered automatically in Salesforce, reducing delays and ensuring integration with other financial systems.

Example

Before: Finance teams spent hours manually validating invoices, leading to delays and frequent errors.

After: Connected to Finance Cloud, Salesforce prompt templates pull live vendor data to auto-complete invoices, reducing manual work and ensuring compliance.

Business Impact

60% reduction in manual validation time

50% faster approval cycles

40% decrease in duplicate invoice errors

30% improvement in compliance accuracy

Use Case 2: Enhancing Expense Management Efficiency with Salesforce Prompt Templates

Expense management ensures that organizations maintain financial control while staying compliant. Manual expense reporting often leads to lost receipts, policy violations, and delayed approvals, impacting both efficiency and cost management which reduces operational costs by salesforce process automation to streamline these workflows and reduce manual errors.

Challenges in Expense Management

Organizations face recurring issues in traditional expense management:

Lost receipts and unreported expenses

Policy violations are going unnoticed

Time-consuming reporting that slows financial decision-making

Solution: Salesforce Prompt Templates

Salesforce AI-driven templates automate key workflows in expense management:

Expense categorization: Automatically classify expenses into travel, meals, lodging, and other categories.

Compliance checks: Flag non-compliant entries, improving audit readiness and reducing policy violations.

Automated reporting: Generate monthly or quarterly reports with minimal manual intervention.

Example Workflow for Expense Management

When an employee uploads a receipt, and if it gets triggered by a Finance Cloud record or flow, a Salesforce prompt template powered by Agentforce processes the invoice data, extracts key details, and updates record fields automatically—ensuring accuracy, faster approvals, and clear visibility.

Business Impact in Expense Management

40% improvement in compliance rates

20% reduction in supply chain inefficiencies

40% increase in sales productivity

Up to 50% cost savings

Use Case 3: Accelerating Contract Analysis with AI

Contract analysis is essential but often tedious. Financial and legal teams must review long contracts filled with complex terms and hidden compliance obligations. Manual reviews are time-consuming, prone to oversight, and can delay decision-making in finance workflows.

Challenges faced Contract Analysis

Critical terms are buried in contracts, such as payment schedules, renewal dates, and compliance obligations

Time-intensive manual reviews are delaying approvals and negotiations

Difficulty comparing drafts with historical agreements to identify risks or deviations

Solution for Contract Analysis : Salesforce Prompt Templates

AI-driven templates simplify contract analysis and help finance teams:

Summarize key terms to facilitate faster decision-making

Flag missing or incomplete clauses around payments, renewals, or compliance

Compare new contracts with past agreements to highlight deviations and potential risks

Example

A legal operations team using Salesforce Finance Cloud with AI templates reduced contract review times from days to hours. AI-powered automation aligns contract analysis with invoice processing, expense management, and compliance documentation, enabling finance teams to save time and reduce operational costs.

Business Impact of Contract Analysis

70% faster contract review cycles

50% reduction in legal and compliance risks

40% improvement in accuracy of financial reporting

60% more consistent compliance documentation

Use Case 4: Simplifying Compliance Documentation with Prompt Template

Compliance is a critical requirement for finance and operations teams. Manual tracking of regulatory updates is slow, error-prone, and costly. Salesforce Finance Cloud, powered by AI-driven financial services automation, simplifies compliance management, ensuring accurate, audit-ready documentation across all financial processes through robust salesforce legal compliance capabilities.

Challenges Compliance Documentation Finance teams face:

Slow, manual compliance checks that delay workflows

Constantly changing regulations requiring continuous monitoring

Oversights in expense management, invoice processing, and reporting

Solution Compliance Documentation : Salesforce Prompt Templates

AI templates support finance teams by:

Auto-generating compliance summaries to quickly meet regulatory requirements

It acts after monitoring tools detect changes.

Preparing audit-ready reports with full Salesforce integration, combining contract, invoice, and expense data

Example in Action

During an audit, AI-driven workflows instantly compile all relevant compliance data from multiple sources. Salesforce process automation ensures accurate, complete audit documentation while reducing operational costs and increasing transparency.

Business Impact in Compliance Documentation

60% faster audit preparation

50% fewer compliance errors

40% time savings for finance teams

30% reduction in operational costs

Here’s a shortened version of the case study table with all keywords included:

| Case Study | Solution with Salesforce | Impact |

|---|---|---|

| AI Claims Processing | AI claims processing Salesforce automation via Salesforce Finance Cloud and Salesforce integration. | Faster claims, improved compliance, and reduced operational costs through Salesforce process automation. |

| Invoice & Expense Management | Salesforce invoice processing and automating expense tracking with Salesforce Finance Cloud. | Streamlined finance workflows in Salesforce and better Salesforce expense management. |

| Compliance & Audit | Salesforce compliance management, Salesforce audit trail compliance, and workflow templates. | Accurate audits and best practices for compliance documentation in Salesforce |

| Contracts & Reporting | Salesforce contract lifecycle management, AI contract analysis, and Salesforce financial reporting tools. | Automated contracts, financial data automation Salesforce, and accurate reporting |

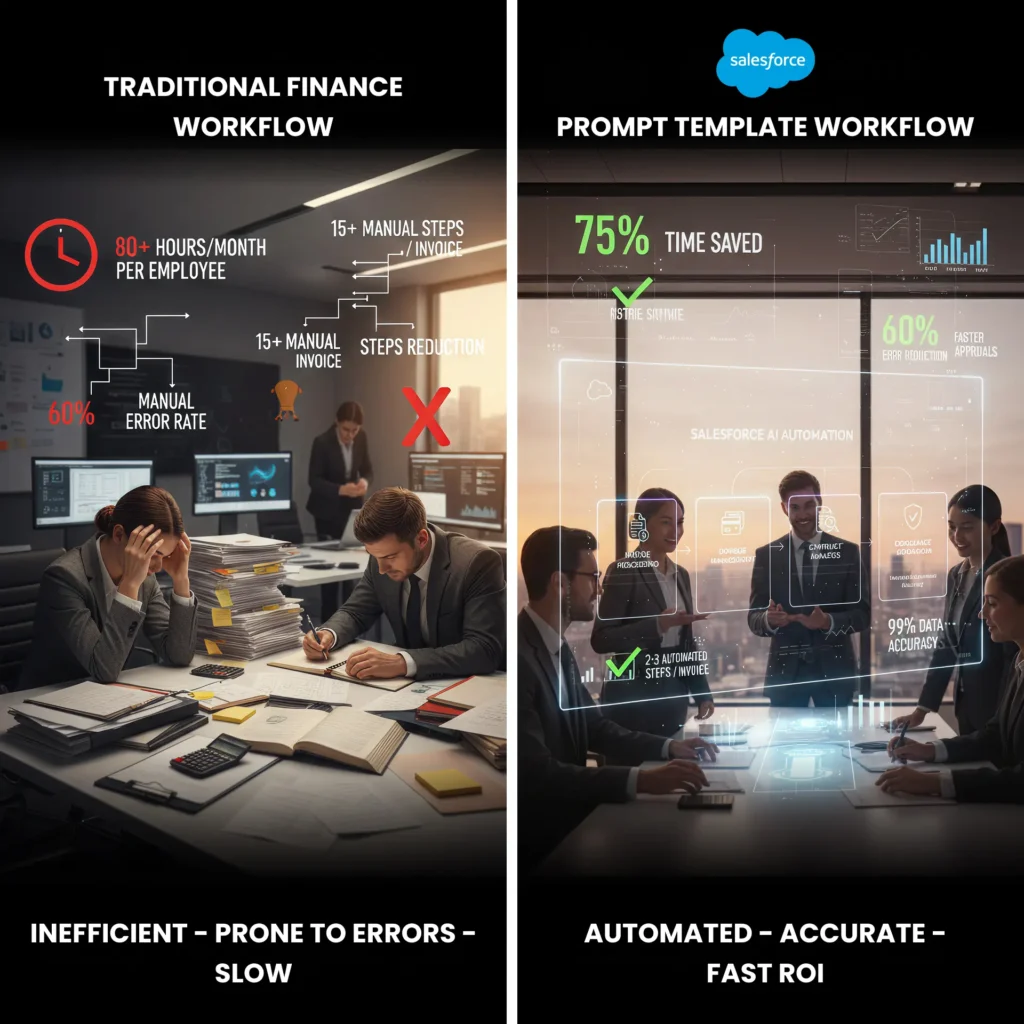

Traditional vs. Prompt Template Workflows in Salesforce Finance

Managing finance workflows in Salesforce has shifted from slow, manual processes to AI-driven, automated operations with prompt templates.

Before (Traditional Workflows):

Finance teams spent 40+ hrs/week on manual documentation in Salesforce Finance Cloud.

Salesforce invoice processing and Salesforce contract lifecycle management were time-consuming and error-prone.

Salesforce compliance management required repeated manual checks, making compliance slow and inconsistent.

Lack of automation in Salesforce Finance and Operations increased operational costs and limited scalability.

After (Prompt Template Workflows):

Salesforce prompt templates for finance and operations workflows cut documentation time dramatically, improving speed.

AI claims processing Salesforce automation ensures accuracy in accounting and reporting.

Best practices for compliance documentation in Salesforce are enforced automatically, improving Salesforce audit trail compliance.

Salesforce fintech service combined with salesforce integration enables companies to reduce operational costs Salesforce processes automation while scaling finance workflows.

Salesforce Financial Services Automation streamlines expense tracking with Salesforce Finance Cloud and supports contract analysis automation with AI templates for improved scalability.

Wind up: Smarter Finance Operations with Prompt Templates

Prompt templates simplify finance workflows by optimizing invoice processing, expense tracking, contract review, and compliance reporting. They ensure accuracy, cost savings, and audit-ready compliance while reducing manual effort. Finance teams gain more time for strategic decisions and improved stakeholder trust. Incorporating prompt templates within Salesforce-driven automation, including ai claims processing salesforce automation delivers measurable efficiency and regulatory alignment.

Transform your finance operations with Salesforce automation

FAQs: Enhancing Finance Workflows in Salesforce with AI Prompt Templates

How do prompt templates improve financial accuracy in Salesforce?

Salesforce prompt templates built in Agentforce pull live CRM data and real-time inputs from Finance Cloud to generate accurate, context-based responses. This removes the need for manual data entry, cuts down on errors, and automatically creates organized financial records right inside Salesforce.

Can AI prompt templates handle compliance across multiple regions?

Yes. Salesforce prompt templates operate within the Salesforce Trust Layer, ensuring compliance and complete audit visibility. When integrated with Finance Cloud and compliance data, they automatically tailor prompts to match region-specific regulations and reporting standards.

What are the security risks of using AI in finance workflows?

While Salesforce integration with AI enhances efficiency, there are risks like unauthorized access, data breaches, and improper handling of financial data. Employing Salesforce financial reporting tools and secure workflow templates, finance can mitigate risks while enabling financial data automation in Salesforce.

Is prompt template automation suitable for SMBs or just enterprises?

Prompt template automation benefits both SMBs and enterprises. By leveraging Salesforce fintech service and Salesforce Finance Cloud, SMBs can automate invoice processing, expense tracking, and contract analysis, reducing operational costs Salesforce process automation while improving finance workflows in Salesforce.